Landmark Property Development Company Ltd is Rated Strong…

Understanding the Current Rating

The Strong Sell rating assigned to Landmark Property Development Company Ltd indicates a cautious stance for investors. It suggests that the stock is expected to underperform relative to the broader market and peers in the Realty sector. This recommendation is based on a comprehensive evaluation of four key parameters: Quality, Valuation, Financial Trend, and Technicals. Each of these factors contributes to the overall assessment of the company’s investment appeal.

Quality Assessment

As of 15 February 2026, Landmark’s quality grade is considered below average. The company has demonstrated weak long-term fundamental strength, with a compound annual growth rate (CAGR) of operating profits at -1.23% over the past five years. This negative growth trend highlights challenges in sustaining profitability and operational efficiency. Additionally, the company’s ability to service its debt is notably poor, reflected in an average EBIT to interest ratio of -3.70, signalling financial stress and potential liquidity concerns. The presence of reported losses has resulted in a negative return on capital employed (ROCE), further emphasising the company’s struggle to generate adequate returns on invested capital.

Valuation Considerations

From a valuation standpoint, Landmark Property Development Company Ltd is classified as risky. The stock is trading at levels that are unfavourable compared to its historical averages, which raises concerns about its price relative to earnings and growth prospects. Despite the stock generating a negative return of -27.59% over the past year, the company’s profits have paradoxically risen by 101.1% during the same period. This disparity is reflected in a high price/earnings to growth (PEG) ratio of 4.9, indicating that the market may be pricing in significant risks or uncertainties that outweigh recent profit improvements. Such valuation metrics caution investors about the potential for further downside or volatility.

Financial Trend Analysis

The financial trend for Landmark is mixed but leans towards positive in certain respects. While the company has shown some improvement in profits, the overall trend remains weak due to persistent losses and poor debt servicing capability. The negative EBITDA and losses reported suggest ongoing operational challenges. The weak long-term growth and negative returns on capital employed underscore the need for investors to be wary of the company’s financial health. These factors collectively contribute to the cautious rating, signalling that the company’s financial trajectory is not yet robust enough to inspire confidence.

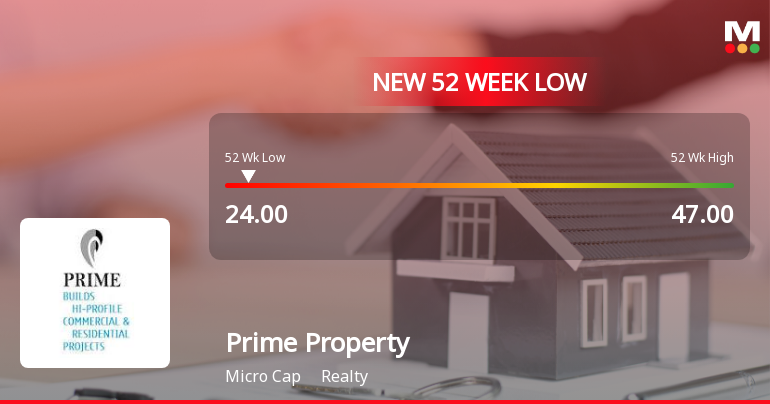

Technical Outlook

Technically, the stock is in a bearish phase. As of 15 February 2026, the stock has experienced consistent declines across multiple time frames: a 1-day drop of -1.25%, a 1-week fall of -4.40%, and a 1-month decrease of -8.70%. Over the last three months, the stock has declined by -15.66%, and over six months by -17.43%. Year-to-date, the stock is down -11.76%. These negative price movements reflect weak investor sentiment and a lack of upward momentum. The stock’s underperformance relative to the BSE500 index over the past three years, one year, and three months further confirms its bearish technical stance.

Implications for Investors

For investors, the Strong Sell rating serves as a warning to exercise caution. The combination of below-average quality, risky valuation, mixed financial trends, and bearish technical signals suggests that Landmark Property Development Company Ltd may face continued headwinds. Investors should carefully consider these factors before initiating or maintaining positions in the stock. The rating implies that the stock is likely to underperform and may not be suitable for risk-averse portfolios or those seeking stable returns in the Realty sector.

Sector and Market Context

Operating within the Realty sector, Landmark is classified as a microcap company, which typically entails higher volatility and risk compared to larger, more established firms. The sector itself has faced challenges recently, with many real estate companies grappling with liquidity constraints and subdued demand. Landmark’s performance and rating must be viewed against this backdrop, where sectoral headwinds may exacerbate company-specific issues.

Summary of Key Metrics as of 15 February 2026

- Mojo Score: 17.0 (Strong Sell)

- Market Capitalisation: Microcap

- Operating Profit CAGR (5 years): -1.23%

- EBIT to Interest Ratio (average): -3.70

- Return on Capital Employed (ROCE): Negative

- PEG Ratio: 4.9

- Stock Returns: 1Y -27.59%, 6M -17.43%, 3M -15.66%, 1M -8.70%, 1W -4.40%, 1D -1.25%

Conclusion

Landmark Property Development Company Ltd’s current Strong Sell rating by MarketsMOJO reflects a comprehensive evaluation of its present-day fundamentals, valuation, financial trends, and technical outlook as of 15 February 2026. While the company has shown some profit growth, the overall weak quality metrics, risky valuation, and bearish price action caution investors about the stock’s near-term prospects. This rating advises a prudent approach, signalling that the stock may continue to face challenges in delivering positive returns relative to the broader market and sector peers.

Unlock special upgrade rates for a limited period. Start Saving Now →

link